Introduction to Mission Portfolio Optimization

Mission portfolio optimization gives the promise of producing and delivering the utmost attainable enterprise worth from the corporate’s mission portfolio. Through the use of knowledge and superior evaluation strategies, organizations can typically generate extra enterprise worth (+20%) with the identical finances and sources as they’ll utilizing guide processes. Mission portfolio optimization stems from monetary portfolio administration idea and is among the most superior processes of mission portfolio administration.

To optimize means to “make the perfect or handiest use of a scenario, alternative, or useful resource” (Dictionary.com). In easy phrases, optimization is about doing the perfect we will with what we’ve received. One other approach to have a look at is “bang for the buck”. Nearly each firm has restricted sources, and the aim is to generate as a lot enterprise worth (“bang”) with the restricted sources accessible (“the buck”).

Optimizing a mission portfolio is to assemble an optimum portfolio given present limitations and constraints. Portfolio optimization closely emphasizes the “science” of mission portfolio administration and may be very a lot knowledge pushed and depends on superior evaluation. This is the reason our PPM maturity mannequin consists of portfolio optimization beginning at degree 3 maturity. Earlier than this, most organizations merely do not need established processes to allow portfolio optimization strategies.

Portfolio optimization is a part of the second element of the mission portfolio lifecycle, ‘Optimize Portfolio Worth’. The aim of mission portfolio administration is to assist organizations ship most enterprise worth. Processes corresponding to prioritization and managing useful resource capability assist us to “make the perfect or handiest use of human sources”. On this approach, organizations can enhance enterprise worth supply. Nevertheless, whereas these processes might assist leaders to assemble a ‘good’ mission portfolio, it possible doesn’t produce the perfect (or optimum) outcomes. This is the reason portfolio optimization very typically ship larger worth with the identical sources and finances. That’s highly effective.

The Completely different Forms of Mission Portfolio Optimization

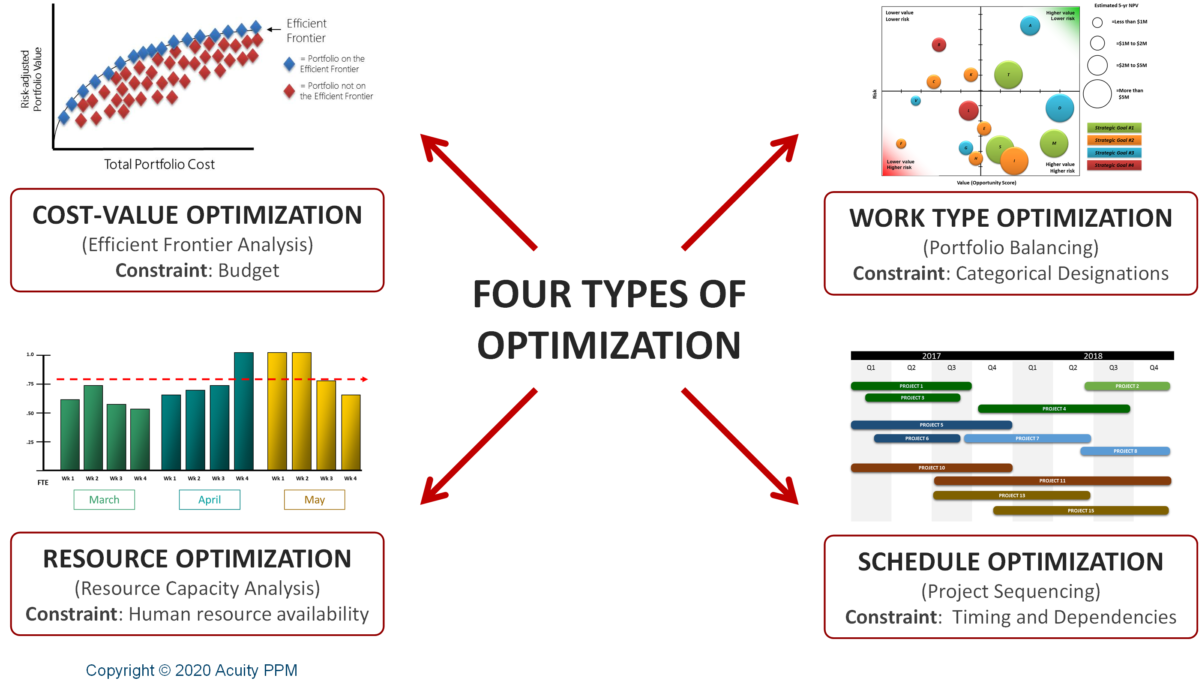

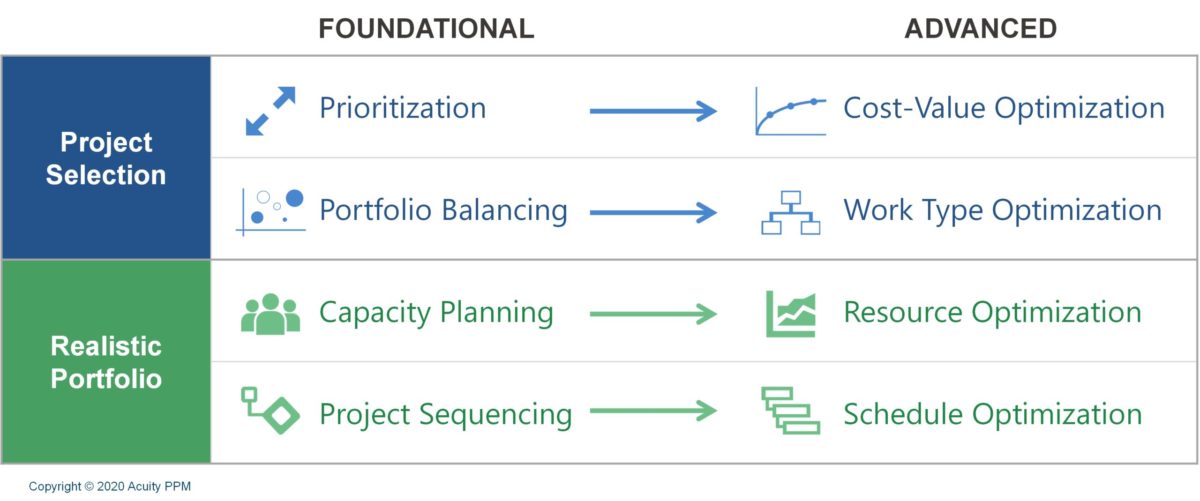

An “optimum” portfolio in your group will depend on the objectives of your portfolio. Not each group will optimize their portfolio in the identical approach, however there are 4 fundamental forms of portfolio optimization:

- Price-Worth Optimization: that is the preferred kind of portfolio optimization and makes use of environment friendly frontier evaluation. The fundamental constraint of cost-value optimization is the portfolio finances.

- Work Sort Optimization: this can be a lesser identified approach of optimizing the portfolio, however corresponds to a extra widespread time period, portfolio balancing. The fundamental constraints of work-type optimization are categorical designations.

- Useful resource Optimization: that is one other efficient approach of optimizing the portfolio and makes use of capability administration evaluation. The fundamental constraint of useful resource optimization is human useful resource availability.

- Schedule Optimization: such a optimization is related to mission sequencing, which pertains to mission interdependencies. The fundamental constraints of schedule optimization are mission timing and mission dependencies.

These 4 forms of optimization are literally superior variations of foundational portfolio administration disciplines. Prioritization as a range method turns into cost-value optimization. Portfolio balancing turns into work kind optimization. Useful resource capability planning turns into useful resource optimization. Mission sequencing turns into schedule optimization. The chart beneath highlights that the cost-value and work kind optimization strategies are used to enhance mission choice whereas useful resource and schedule optimization are used to construct a practical portfolio.

Corporations don’t want to make use of each method, however using a number of strategies can produce essentially the most optimum portfolio in your group. With a purpose to efficiently optimize a portfolio, two key issues are wanted: the appropriate knowledge, and the appropriate constraints. With out enough knowledge, the portfolio can’t be optimized. From this angle, accumulating a enough quantity of the appropriate knowledge is immediately tied to organizational maturity. Much less mature organizations won’t have the self-discipline or processes in place to gather sufficient good knowledge. Information is the gasoline that makes the portfolio engine run; with out sufficient good knowledge, there’s inadequate “energy” to optimize the portfolio. Furthermore, if the info is just not refreshed with some regularity, the optimization outputs turn out to be stale. Mature organizations will accumulate good knowledge throughout Work Consumption and produce other processes in place to commonly enter new mission knowledge into its portfolio system, enabling it to optimize the portfolio on a recurring foundation.

As well as, the appropriate constraints must be recognized, understood, and communicated among the many portfolio governance staff. A constraint is a limitation imposed upon the group or a restriction set by the portfolio governance staff. With out acknowledging and figuring out key constraints, it isn’t attainable to optimize the portfolio and maximize organizational worth. Every facet of portfolio optimization has its personal constraints and will likely be mentioned in additional element beneath.

Price-Worth Portfolio Optimization (aka Environment friendly Frontier Evaluation)

One of many fundamental tenets of mission portfolio administration (PPM) is to maximise the worth to the group by its tasks. This may be achieved by conventional cost-value optimization (mostly often known as discovering the ‘environment friendly frontier’). The aim is to determine the mixture (or combine) of tasks that generates essentially the most enterprise worth for a given finances degree. In different phrases, when you have a $30 million greenback mission finances, how way more enterprise worth are you able to generate in comparison with a $25 million greenback finances? You need to be capable to generate way more worth, however the secret is to pick out the appropriate mixture of tasks to unlock that worth. Price-value optimization can doubtlessly enhance portfolio worth by 20% with out making any further investments.

Price-Worth Optimization is a Superior Mission Choice Approach

Price-value optimization is a superior mission choice method. In our article on prioritization, we mentioned a quite common strategy for rank ordering tasks and deciding on tasks from high to backside till finances ran out. This strategy will yield a fairly good outcome, nevertheless it won’t produce the perfect outcome. Merely prioritizing tasks and “drawing the road” if you run out of finances won’t unlock most worth. What most organizations fail to do is determine the perfect total mixture of tasks to maximise enterprise worth. In truth, it’s attainable for 2 decrease precedence tasks collectively to ship extra enterprise worth than one greater precedence mission. Richard Bayney, in his article “Making a Portfolio of Prioritized Tasks”, does a fantastic job of exhibiting how rank ordering produces an inferior portfolio choice outcome to portfolio optimization. Price-value optimization requires senior leaders to reframe mission choice by specializing in maximizing enterprise worth, not merely deciding on solely the best ranked tasks.

With cost-value optimization, the fundamental constraint is the organizational finances for tasks. Usually, organizations may have a hard and fast whole mission finances, or no less than a powerful estimate of how a lot it could actually spend over a given 12 months or interval. For these organizations that won’t have a hard and fast finances, environment friendly frontier evaluation can nonetheless present goal portfolios at completely different price factors.

The Environment friendly Frontier

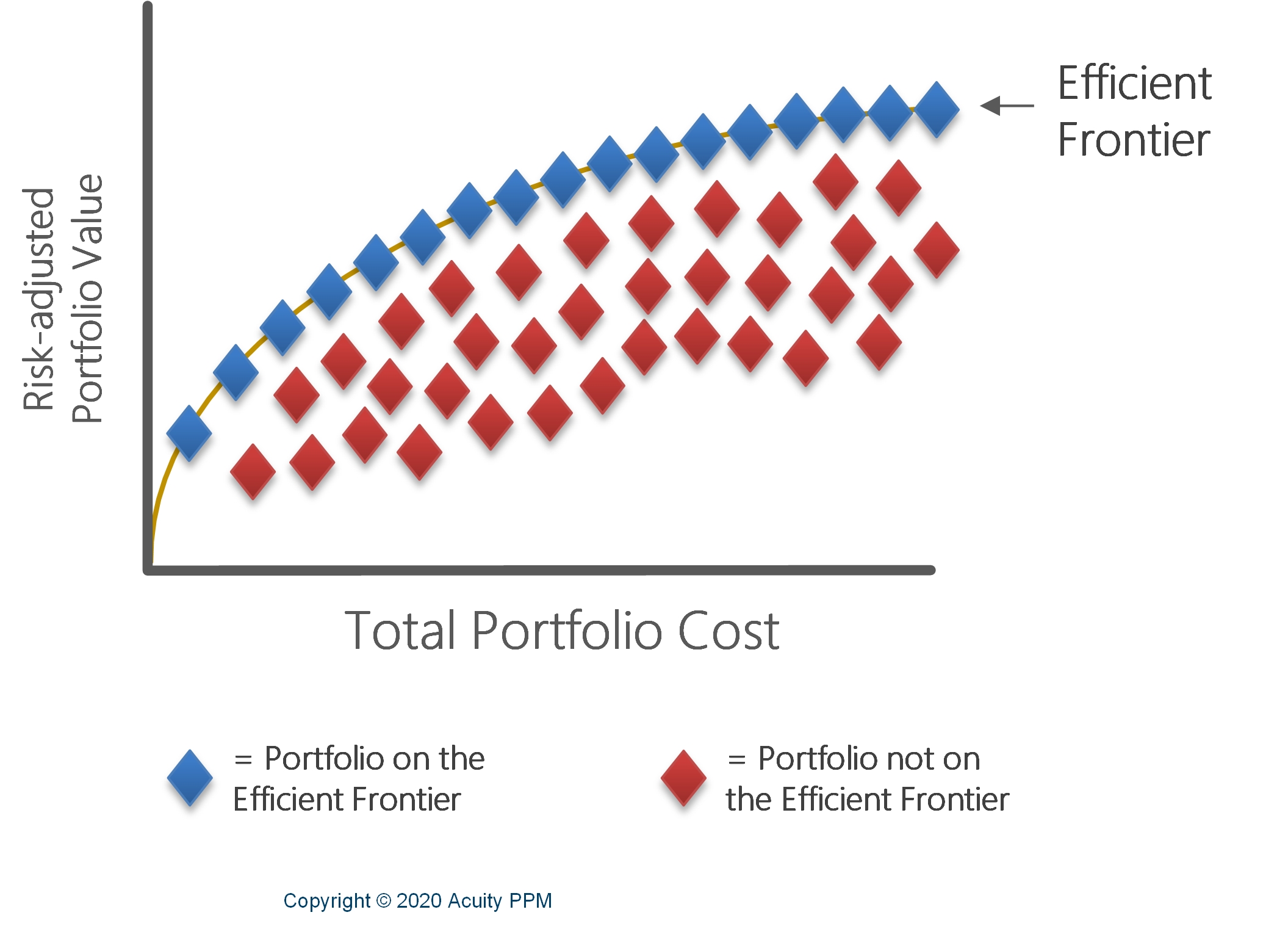

Conventional portfolio idea (used for monetary portfolios) applies the idea of an “environment friendly frontier” (determine beneath), the factors at which for a given quantity of funding there’s an optimum portfolio offering most profit.

Lee Merkhofer, a portfolio administration professional, has this to say about utilizing the environment friendly frontier for portfolio optimization: “Within the context of contemporary portfolio idea, the environment friendly frontier is the bounding curve obtained when portfolios of attainable investments are plotted primarily based on danger and anticipated return. The environment friendly frontier exhibits the funding mixtures that produce the best return for the bottom attainable danger. A portfolio that isn’t on the environment friendly frontier is alleged to be ‘inefficient’ as a result of one other portfolio exists that has decrease danger for a similar return. The aim for choosing tasks is to choose mission portfolios that create the best attainable risk-adjusted worth with out exceeding the relevant constraint on accessible sources. Economists name the set of investments that create the best attainable worth in any case attainable price the ‘environment friendly frontier.’ Most organizations fail to seek out the perfect mission portfolios and, due to this fact, don’t create most worth. Incapability to seek out the environment friendly frontier is [another] purpose organizations select the improper tasks.” Portfolio Managers and Portfolio Governance Groups ought to underneath the portfolio danger tolerance thresholds so as to optimize danger and worth within the portfolio.

As a lot as corporations need “data-driven determination making”, if the optimization outputs are opposite to their expectations, they may have a more durable time accepting the outcomes. Open dialogue is required to degree set expectations with management.

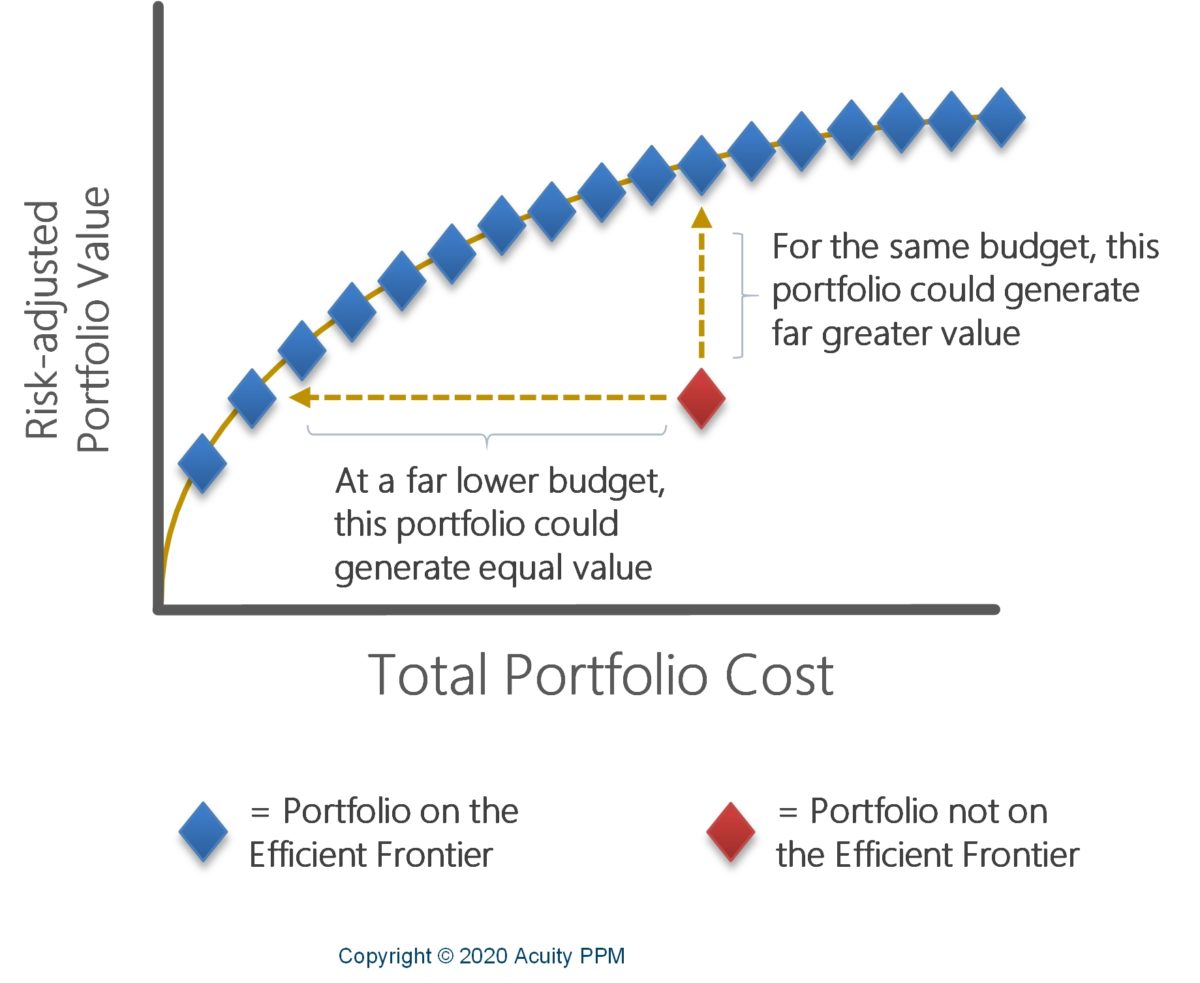

Within the instance beneath, we will see a portfolio (purple diamond) that isn’t on the environment friendly frontier. For a similar finances, this portfolio might generate far larger worth. At a decrease finances, this portfolio might generate equal worth. Though most organizations choose to maximise the worth for his or her most finances goal, this view is helpful to remember for executives to know that senior leaders typically depart cash on the desk or pay an excessive amount of for the worth they’re getting.

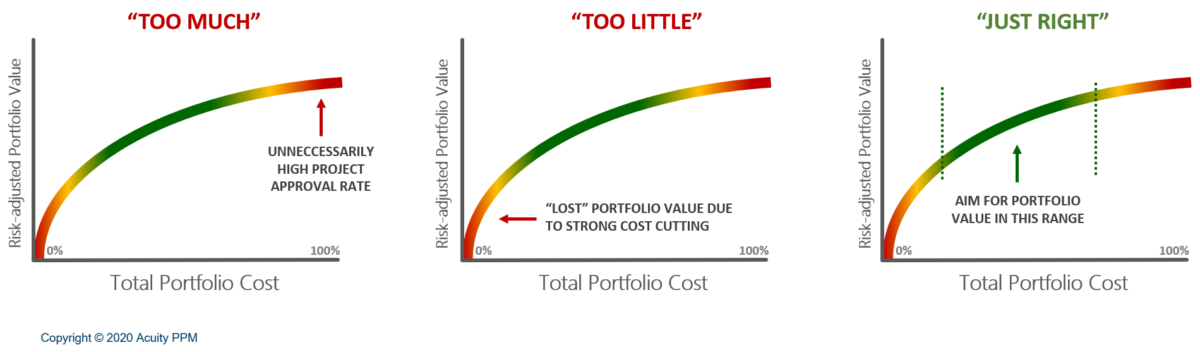

Listed here are three extra views to conclude our dialogue on the environment friendly frontier. In my expertise, I’ve seen many corporations merely attempt to approve every thing on their listing. This is able to put a portfolio within the higher proper nook of the environment friendly frontier. There are important diminishing returns as you strategy that spectrum of the environment friendly frontier. Often all these additional tasks are low-value ‘good to have’ tasks that eat sources however add little or no worth. Corporations must be cautious of these forms of tasks. On the different finish, some corporations might make distinctive finances cuts and lose alternatives to ship enterprise worth. At that finish of the spectrum, even modest will increase in portfolio finances can result in way more enterprise worth. There’s a cautious steadiness when making use of environment friendly frontier evaluation and we’ll cowl these challenges on the finish of this text.

You Should Outline Portfolio Worth

Conventional portfolio idea assumes mission and portfolio worth is strictly a monetary worth. Nevertheless, mission worth must also embrace a number of qualitative (or intangible) advantages that aren’t measured strictly by internet current worth (NPV) or return on funding (ROI). The portfolio’s worth must also correspond to strategic supply and conducting the strategic objectives of the group.

You’ll want to refer again to our article on prioritization. There, we lined the significance of getting the portfolio governance staff outline ‘worth’, which is able to differ at each firm. As soon as worth is outlined, a scoring mannequin might be created to judge mission worth. These prioritization ‘scores’ characterize relative mission worth and may then be used to optimize the portfolio. With out defining worth, senior leaders will solely be capable to optimize the portfolio from a purely monetary standpoint, and this won’t result in optimum strategic outcomes. By factoring in strategic alignment and different enterprise drivers, a greater evaluation of mission worth might be produced and used to optimize the mission portfolio.

The appliance of the environment friendly frontier strategy can save the portfolio governance staff time on mission choice as a result of it focuses on the set of tasks that delivers most worth for a selected degree of spending. As a substitute of preventing for what needs to be included, the dialogue might be targeted on these tasks that convey the portfolio off of the environment friendly frontier (corresponding to obligatory tasks that don’t present a lot worth). To make use of a golf analogy, utilizing the environment friendly frontier won’t offer you a ‘gap in a single’ (i.e. it received’t provide the ultimate reply), however it’s going to get you to the placing inexperienced practically each time in a single stroke (i.e. save time by getting very near the ultimate reply). Each golfer would take that.

Work Sort Portfolio Optimization

A complementary optimization strategy to enhance mission choice is what we confer with as work kind optimization. Basically, such a optimization helps guarantee a balanced funding throughout the portfolio and can be utilized together with cost-value optimization. The idea of ‘portfolio steadiness’ is sort of widespread in PPM literature. We see it come up in relation to risk-value bubble charts so as to visualize the portfolio and be sure that senior management is just not overinvesting in low-value or high-risk areas.

Steadiness may also assist a distributed funding technique throughout:

- Enterprise items

- Product strains

- Classes (corresponding to run, develop, remodel)

- Strategic objectives

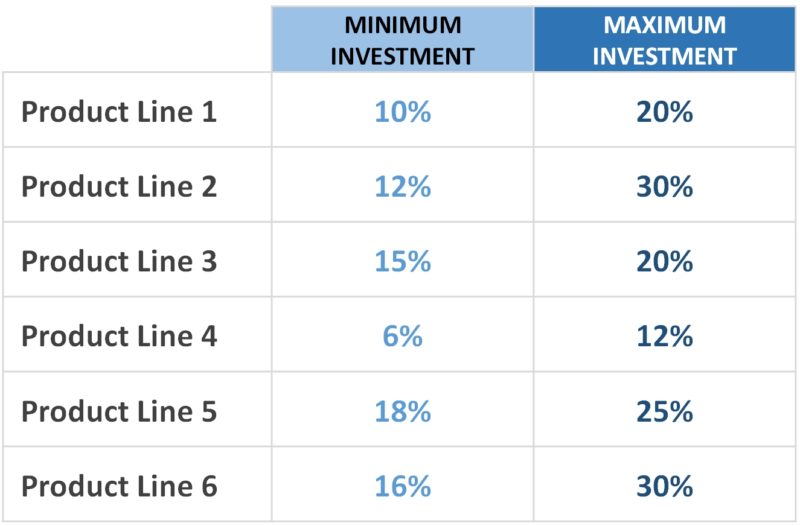

With a purpose to optimize the portfolio in keeping with work varieties (or classes) the portfolio governance staff must set funding ranges throughout the classes they need to optimize towards. The easy desk beneath captures the funding vary {that a} portfolio governance staff might need to put into every of its six product strains. These values are used as a part of an optimization algorithm to make sure an appropriate steadiness of funding. If the ranges are too slim, it could actually restrict the choices accessible to the portfolio governance staff.

Optimizing a mission portfolio is to assemble an optimum portfolio given present limitations and constraints. Portfolio optimization closely emphasizes the “science” of mission portfolio administration and may be very a lot knowledge pushed and depends on superior evaluation.

Useful resource Optimization

Useful resource optimization takes a unique strategy to optimizing the portfolio by addressing useful resource constraints that exist in apply. Useful resource optimization focuses on useful resource utilization and availability so as to assemble a practical portfolio that may be achieved and delivered. One of many shortcomings of cost-value optimization is that it doesn’t immediately incorporate useful resource availability and utilization into the evaluation. That strategy might yield an optimum portfolio from a worth perspective however one that’s unrealistic to ship due to identified useful resource constraints.

Useful resource optimization is an extension of useful resource capability planning. In our article on the challenges of managing useful resource capability we lined that good mission planning is the muse of capability planning; with out affordable mission planning capability planning is solely not attainable. So long as there’s affordable mission planning with ok useful resource estimates, some degree of useful resource optimization is feasible. We’ll briefly contact two approaches.

Method #1 – Annual Utilization

An easier strategy that organizations can get began with is to optimize a number of key sources at an annual planning degree. This entails estimating the useful resource utilization for every position for every mission for a given fiscal 12 months. So long as there’s some affordable understanding of the true capability of every position, an optimum mixture of tasks might be discovered to suit inside identified useful resource constraints.

One of many main advantages of this simplistic strategy is that corporations can extra simply decide what number of tasks might realistically be labored on over the course of a 12 months. Nevertheless, there are a number of down sides. This strategy doesn’t keep in mind the timing of when sources are wanted, so there should be intervals of time with unrealistic workloads because of the timing of the tasks. It additionally assumes that the useful resource estimates are fairly good; when making an attempt to optimize the portfolio at such a excessive degree, even minor modifications to useful resource estimates might significantly change the combination of tasks chosen as a part of the optimization. Nonetheless, this strategy might help assist annual planning workout routines.

Method #2 – Time phased useful resource plan

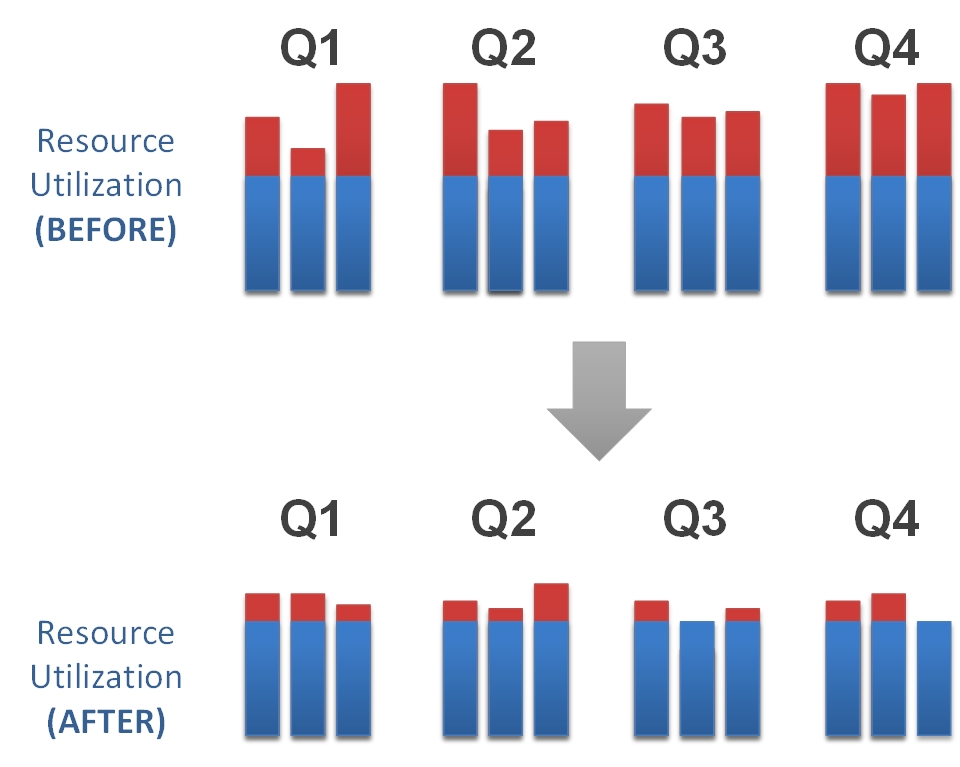

Optimizing towards a time-phased useful resource plan is extra superior, more durable to do, however will produce a greater output. This strategy assumes {that a} month by month useful resource plan is ready with good useful resource forecasts. This may be executed manually by state of affairs planning, however solely specialised software program can assist real useful resource optimization. Please notice that we aren’t referring to ‘useful resource leveling’, which is the place useful resource masses are smoothed out however mission durations are prolonged. This isn’t useful resource optimization. Somewhat, we’re targeted on sequencing tasks in keeping with useful resource utilization and capability so as to decrease over-utilized sources. The graphic beneath highlights that re-sequencing tasks throughout the portfolio can scale back over-utilization and even perhaps take away pointless tasks so as to unencumber vital sources.

Schedule Optimization

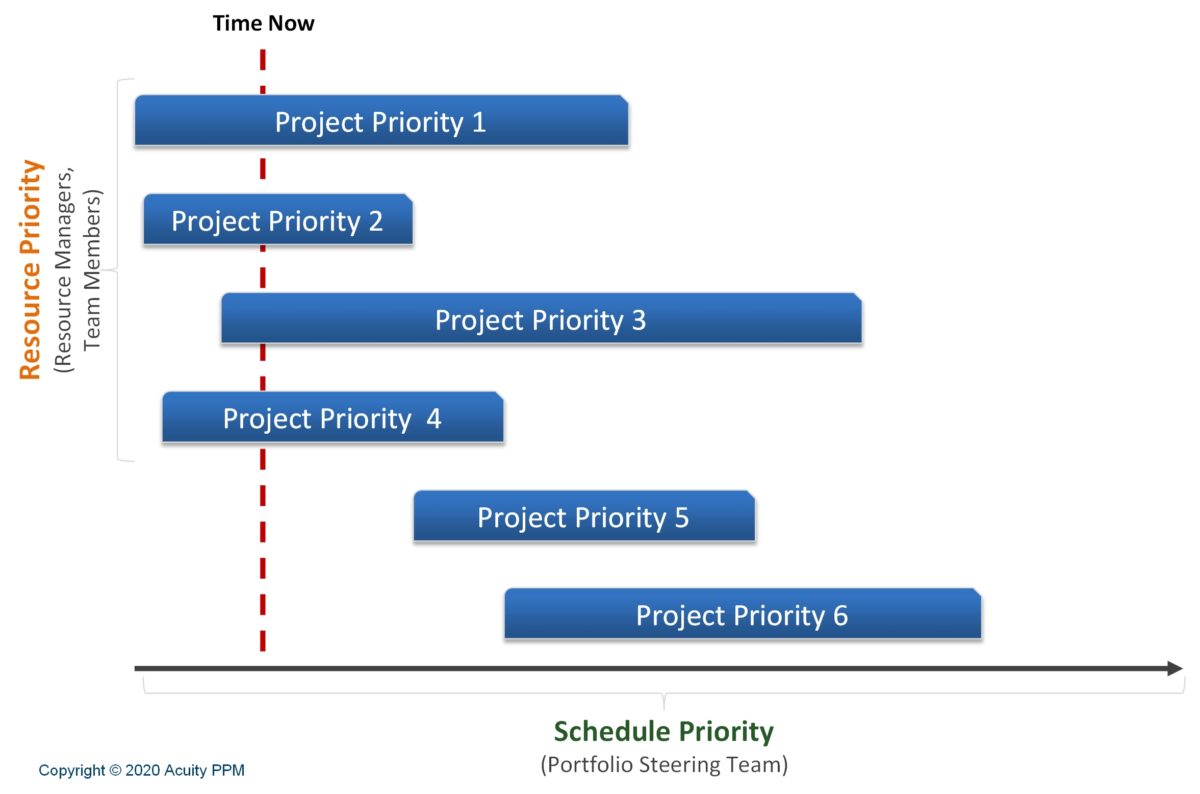

The final kind of portfolio optimization is schedule optimization in a multi-project atmosphere. This accounts for all mission interdependencies throughout tasks. In relation to mission sequencing, organizations must also account for mission priorities and useful resource availability (see graphic). There are no less than two approaches that we’ll spotlight beneath.

Multi-Mission Essential Path

Some organizations might load dependencies between tasks right into a grasp built-in schedule and apply vital path scheduling to create the perfect scheduling community throughout tasks. It is a truthful strategy that may assist groups enhance scheduling throughout tasks.

Multi-Mission Essential Chain

We imagine that an much more invaluable strategy is to account for vital bottleneck sources. That is the place Essential Chain Mission Administration (CCPM) might be very efficient for optimizing the schedules of a number of tasks throughout the portfolio.

Essential Chain Mission Administration originates from the Principle of Constraints which emphasizes that each system has a bottleneck or ‘constraint’ which limits the output (throughput) of or service. Essential Chain Mission Administration is a mission administration software of the Principle of Constraints that acknowledges {that a} small variety of key sources (‘bottleneck sources’) are the important thing constraints to finishing mission work on time. When Mission Managers perceive the useful resource constraints and schedule in keeping with it, they’ll obtain incredible outcomes.

Making use of Essential Chain Mission Administration combines each useful resource optimization and schedule optimization collectively. It prioritizes the scheduling of duties that make the most of bottleneck sources in such a approach that the bottleneck sources should not over-utilized whereas nonetheless accounting for different schedule dependencies and relationships throughout mission schedules. There are a selection of different vital principals related to CCPM (corresponding to buffer administration) which are past the scope of this text, however are vital for efficiently adopting CCPM.

Challenges of Mission Portfolio Optimization

We’ll now flip our consideration to the challenges related to portfolio optimization. As we talked about firstly, mission portfolio optimization requires extra superior processes and is usually initiated as organizations attain degree 3 maturity in keeping with our portfolio maturity mannequin. Whereas mission portfolio optimization might help organizations maximize enterprise worth supply, there are a selection of challenges that have to be addressed so as to see these advantages.

Getting management assist of the outputs

The primary main problem is getting senior leaders to assist the outputs of any optimization. With cost-value optimization, the advisable portfolio might not match management expectations. In truth, two decrease precedence tasks could also be favored by the optimization mannequin over one greater precedence mission, which is able to possible frustrate the sponsor of the upper precedence mission. As a lot as corporations need “data-driven determination making”, if the optimization outputs are opposite to their expectations, they may have a more durable time accepting the outcomes. Open dialogue is required to degree set expectations with management.

A technique of getting round that is to make use of cost-value optimization to create two or three portfolio situations to let senior leaders focus on the deserves of 1 portfolio state of affairs over one other. Or, an optimization strategy will possible embrace among the similar tasks throughout all three situations. From there, the portfolio governance staff can weigh in on the tasks that had been included in one of many situations however not all three after which make a ultimate determination on the smaller set of tasks. Management must also study to problem any tasks that convey a portfolio off of the environment friendly frontier. On this approach, the portfolio governance staff can study to maximise portfolio worth.

The portfolio optimization fashions can not think about all standards

One other problem is the place an optimization mannequin can not presumably account for the entire determination standards. In some instances, mission choice entails some very distinctive standards that will in any other case be laborious to mannequin. Choosing a portfolio primarily based on a number of elements will undoubtedly omit some crucial determination standards that the management staff understands. Examples of this will embrace firm mandates, regulatory compliance, or different work required to maintain the enterprise working. These kinds of tasks might get excluded from cost-value optimization as a result of they’ve decrease enterprise worth however nonetheless produce other standards that requires them to be executed. Organizations might select to exclude all mandated tasks from cost-value optimization evaluation and easily modify the finances accordingly.

Amassing sufficient knowledge and having the appropriate knowledge on the proper time

One vital success issue for making portfolio optimization profitable is to have “lean” processes that make it fairly simple to gather mission and portfolio knowledge and use the info to optimize the portfolio. If organizational processes are too cumbersome, or if the info is simply too laborious to gather, the portfolio optimization course of will likely be much less invaluable and sure changed with much less efficient (however simpler) processes.

Not having sufficient choices to select from

At some corporations, a proposed listing of tasks is submitted that simply meets the deliberate finances. On this case, there aren’t any options to select from and due to this fact no optimized portfolio. The portfolio governance staff ought to have no less than a number of choices to select from so as to choose the perfect portfolio attainable. By approving every thing on the listing, there isn’t any method to optimize the portfolio from a cost-value perspective.

Mockingly, having too many choices to select from may also create challenges. When there are too many choices, even refined modifications to cost-value optimization standards and mission inputs (corresponding to mission finances) can produce significantly completely different outcomes. Be aware of getting too many mission choices; even with out using optimization strategies it may be troublesome for determination makers to agree on a mission portfolio when there are too many tasks to select from.

Creating the appropriate cadence for portfolio optimization

Since optimization strategies can change the composition of the portfolio or the sequencing of tasks and sources, further consideration must be given to the frequency of using optimization strategies. Price-value optimization may be used for annual planning, however what about mission requests that are available in throughout the 12 months? Will optimization be used all year long? And the way does the portfolio governance staff deal with energetic tasks which are not a part of the optimization output? Portfolio Managers want to attract up pointers for a way optimization strategies will likely be used and utilized, in any other case portfolio optimization can doubtlessly disrupt mission supply.

Not having inner experience portfolio optimization

Lastly, corporations might not have enough inner experience to efficiently optimize the portfolio even when all the info is obtainable. Mission portfolio optimization does require the appropriate knowledge evaluation expertise. Corporations that lack this ability set internally ought to get exterior assist with optimizing the portfolio. Sooner or later, we imagine that Synthetic Intelligence and Machine Studying will significantly enhance portfolio optimization.

How To Get Began With Portfolio Optimization

Crucial issue for efficiently using portfolio optimization strategies is to have good high quality knowledge with agreed upon constraints. This consists of a company’s potential to translate their strategic objectives and aims into significant enterprise drivers that may be integrated into an optimization mannequin. Your Portfolio Supervisor performs a vital position with growing and establishing portfolio optimization processes. Listed here are some steps to take to get began with every dimension of portfolio optimization:

Price-Worth Portfolio Optimization

- Set up a sturdy prioritization scoring mannequin – it will allow the portfolio governance staff to obviously consider a mission’s worth. It will embrace qualitative elements corresponding to alignment to strategic objectives and different enterprise drivers. The ensuing output, the worth rating, can then be utilized for cost-value optimization.

- Set up good mission planning – be certain that the mission groups absolutely perceive the scope and value of their mission. In any other case, portfolio optimization will likely be far much less efficient. On the very least, ensure that mission scope is fairly effectively understood and an inexpensive price estimate might be produced. Once more, if mission prices change over time as a result of altering scope, this will intervene with efficient optimization.

- Set up floor guidelines for a way portfolio optimization will likely be used – this consists of coaching management on how portfolio optimization works and get settlement for a way optimization outcomes will inform ultimate portfolio choice.

- Conduct optimization – this will entail constructing a mannequin a spreadsheet or use of different refined software program.

Work Sort Portfolio Optimization

- Outline categorical designations – corporations prepared to start making use of optimization strategies in all probability have already got enough categorical designations, but when not, make sure that everybody on the portfolio governance staff understands the categorizations. For instance, run/develop/remodel is a standard paradigm, however many corporations nonetheless wrestle to categorize tasks as a result of the definitions should not effectively understood.

- Guarantee every mission is categorized – this can be a knowledge integrity step to make sure that all tasks are categorized appropriately.

- Outline funding ranges for every class – the portfolio governance staff must agree on funding ranges for every work kind (e.g. class, enterprise unit, strategic goal, product line, and many others.).

- Conduct optimization – this will entail constructing a mannequin a spreadsheet or use of different refined software program.

Useful resource Optimization

- Set up good mission planning – we lined this in nice element in our article on useful resource capability planning. Mission groups should know tips on how to create a mission plan with scope, actions, dependencies, period estimates, and useful resource estimates. With out this, each capability planning and useful resource optimization should not attainable. This may occasionally require devoted coaching by the Mission Administration Workplace (PMO).

- Create a useful resource plan for every mission – on the very least, total useful resource estimates needs to be compiled so as to conduct the less complicated model of useful resource optimization. For superior useful resource optimization, a time phased useful resource plan is required in addition to refined software program to deal with such a optimization.

- Conduct optimization – this will entail constructing a mannequin a spreadsheet or use of different refined software program.

Schedule Optimization

- Outline good built-in scheduling apply – simplified mission administration and mission instruments won’t work with full schedule optimization. Mission Managers must be effectively versed in tips on how to create an built-in schedule that may calculate a vital path (or make the most of Essential Chain Mission Administration).

- Set up a course of to create a multi-project view – so as to optimize schedules throughout a portfolio, all mission scheduling knowledge must be linked.

- Prioritize tasks to assist sequencing – a very powerful tasks ought to take schedule precedence over decrease worth tasks.

- Incorporate bottleneck sources (if utilizing Essential Chain) – Essential Chain Mission Administration does a wonderful job of mixing useful resource optimization and schedule optimization collectively, however portfolio governance groups must agree on which key sources needs to be included on this evaluation.

- Conduct optimization – this requires the usage of refined scheduling software program.

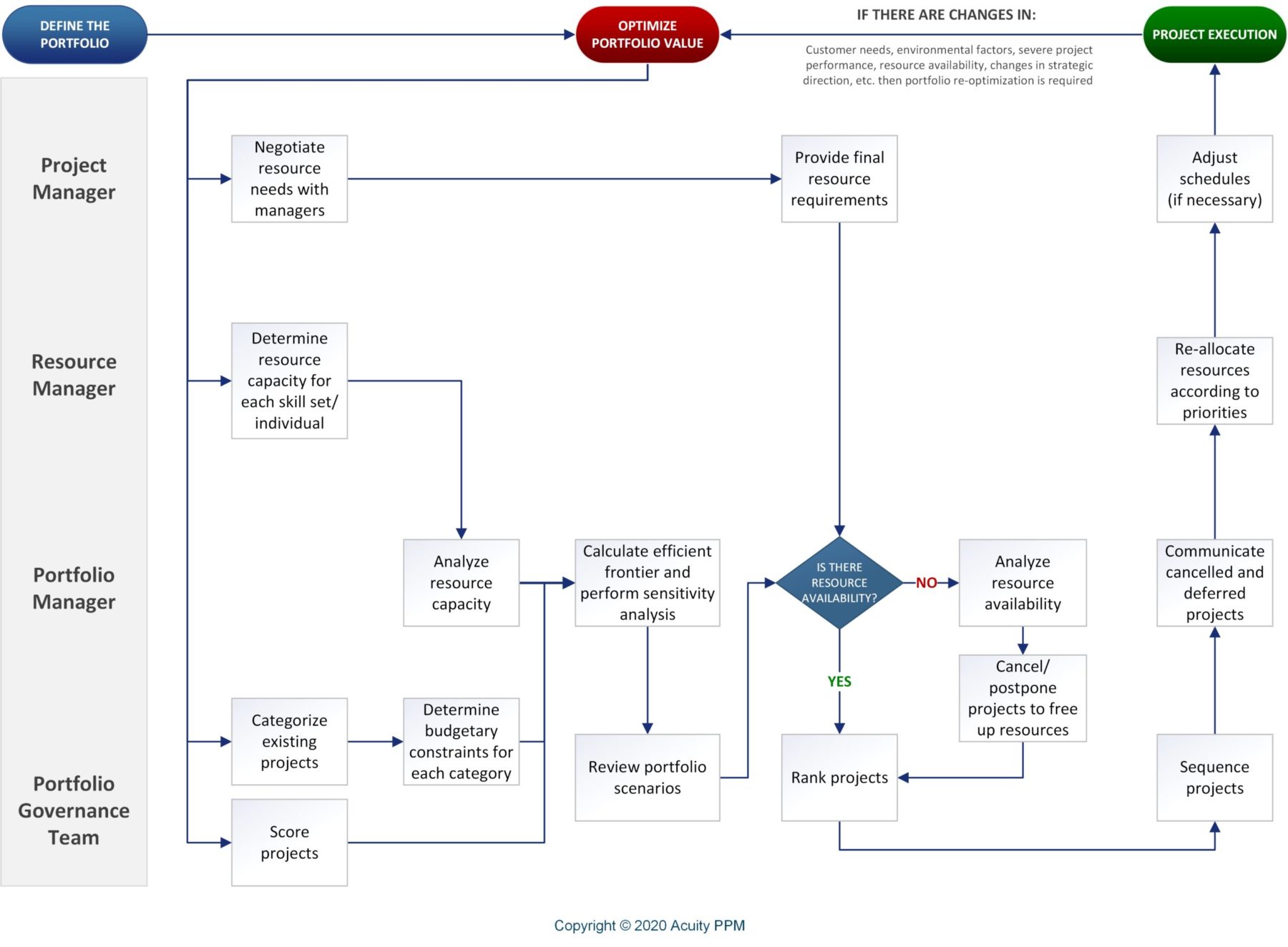

Pattern Course of for Optimization

The diagram beneath represents a pattern strategy for dealing with portfolio optimization.

- The Mission Supervisor will negotiate useful resource wants with Useful resource Managers primarily based on the mission plan.

- The Useful resource Supervisor will decide the useful resource capability for every requested particular person.

- The Portfolio Supervisor will analyze useful resource capability.

- The Portfolio Governance Crew will categorize current tasks and decide budgetary constraints for every class.

- The Portfolio Governance Crew can even rating every mission (if not already executed) utilizing their prioritization scoring mannequin.

- The Portfolio Supervisor will take these inputs and carry out portfolio optimization and conduct sensitivity evaluation.

- The Portfolio Governance Crew will evaluate the situations created by the Portfolio Supervisor.

- Mission Managers will present ultimate useful resource necessities (if not executed earlier)

- The Portfolio Supervisor will consider useful resource availability and advocate sure tasks to be cancelled or postponed if useful resource availability is insufficient.

- The Portfolio Governance Crew will determine if any tasks must be cancelled or deferred after which end rating tasks and assist mission sequencing.

- The Portfolio Supervisor will assist talk any tasks which have been cancelled or deferred.

- Useful resource Managers will re-allocate their sources in keeping with up to date priorities.

- Mission Managers will modify schedules as wanted in assist of priorities, sources, and sequencing.

- Mission supply continues.

A Portfolio Supervisor ought to actively monitor the portfolio and advocate one other optimization train when sure standards are met. The listing beneath highlights a number of situations throughout mission execution which will immediate the portfolio to be re-optimized:

- New mission requests are proposed

- Vital modifications happen within the enterprise atmosphere

- Buyer wants change

- Enterprise emergencies affect mission(s)

- Mission efficiency deteriorates

- Useful resource availability modifications

- Strategic route modifications

VIDEO: Mission Portfolio Optimization

Portfolio Optimization Abstract

Mission portfolio optimization can significantly enhance portfolio worth and considerably enhance the chance of success, however the strategies required are sometimes carried out by extra mature organizations. Establishing good portfolio administration self-discipline lays the muse for strong portfolio optimization. Corporations needs to be inspired to mature their processes so as to have the ability to make the most of completely different optimization strategies. Mission portfolio optimization depends closely on the “science” of PPM, however good management (“the artwork”) is required so as to efficiently apply optimization outputs. Whereas decrease maturity organizations could possibly full a one-time optimization train with the assistance of an outdoor professional, greater maturity is required to ensure that corporations to carry out these superior portfolio optimization strategies persistently on their very own.

Tim is a mission and portfolio administration advisor with over 15 years of expertise working with the Fortune 500. He’s an professional in maturity-based PPM and helps PMO Leaders construct and enhance their PMO to unlock extra worth for his or her firm. He is among the unique PfMP’s (Portfolio Administration Professionals) and a public speaker at enterprise conferences and PMI occasions.

What’s mission portfolio optimization?

Optimizing a mission portfolio is to assemble an optimum portfolio given present limitations and constraints. To optimize means to “make the perfect or handiest use of a scenario, alternative, or useful resource” (Dictionary.com). In easy phrases, optimization is about doing the perfect we will with what we’ve received. One other approach to have a look at is “bang for the buck”. Nearly each firm has restricted sources, and the aim is to generate as a lot enterprise worth (“bang”) with the restricted sources accessible (“the buck”).

What are the alternative ways for optimizing the mission portfolio?

Price-Worth Optimization: that is the preferred kind of portfolio optimization and makes use of environment friendly frontier evaluation. The fundamental constraint of cost-value optimization is the portfolio finances. Work Sort Optimization: this can be a lesser identified approach of optimizing the portfolio, however corresponds to a extra widespread time period, portfolio balancing. The fundamental constraints of work-type optimization are categorical designations. Useful resource Optimization: that is one other efficient approach of optimizing the portfolio and makes use of capability administration evaluation. The fundamental constraint of useful resource optimization is human useful resource availability. Schedule Optimization: such a optimization is related to mission sequencing, which pertains to mission interdependencies. The fundamental constraints of schedule optimization are mission timing and mission dependencies.

How is the environment friendly frontier utilized in PPM?

Conventional portfolio idea (used for monetary portfolios) applies the idea of an “environment friendly frontier”, the factors at which for a given quantity of funding there’s an optimum portfolio offering most profit. Senior leaders must take into account that utilizing the environment friendly frontier helps them understand when cash is being left on the desk or pay an excessive amount of for the enterprise worth they’re getting. In some instances, for a similar finances, a portfolio might generate far larger worth. At a decrease finances, a portfolio might generate equal worth.

What are among the challenges of using mission portfolio optimization?

There are a selection of challenges corporations want to concentrate on so as to make the most of portfolio optimization corresponding to: getting management assist of the optimization outputs, recognizing that portfolio optimization fashions can not think about all standards, accumulating sufficient knowledge and having the appropriate knowledge on the proper time, not having sufficient mission choices to select from, growing the appropriate cadence for portfolio optimization, and never having staff who know tips on how to optimize the portfolio.