Portfolio threat administration permits organizations to guard portfolio investments and stability the extent of threat within the portfolio. Organizations targeted on bettering their portfolio administration self-discipline will probably be ready to start portfolio threat administration after they’ve established work consumption and prioritization processes. The COVID-19 disaster with its huge affect on firms and industries is a latest instance of why it can be crucial for organizations to determine mission portfolio threat administration processes to safeguard the portfolio and its worth. This publish will present a whole overview of portfolio threat administration and conclude with portfolio threat administration software program.

What’s Portfolio Danger Administration?

The frequent view of portfolio threat administration includes processes to establish, assess, measure, and handle threat throughout the portfolio. These steps are related in process with conventional mission and program threat administration. Nevertheless, not like mission threat administration which is concentrated on occasions that might affect the mission, portfolio threat administration is concentrated on occasions that might affect the accomplishment of strategic targets. The scope of portfolio threat administration is much broader than program and mission threat administration and requires senior management involvement.

In our overview of mission portfolio administration, we highlighted that the objective of portfolio administration is to maximize enterprise worth supply. Portfolio threat administration is a crucial success consider a company’s means to ship extra enterprise worth. Organizations that proactively handle portfolio threat are higher geared up to tackle extra threat, enhance portfolio worth, and have a better price of profitable mission supply. Organizations that ignore portfolio threat administration will sub-optimize their mission supply and doubtlessly jeopardize excessive precedence tasks. For this text, we are going to consult with dangers as having a possible unfavourable affect on the portfolio, and alternatives as having a possible optimistic affect to the portfolio.

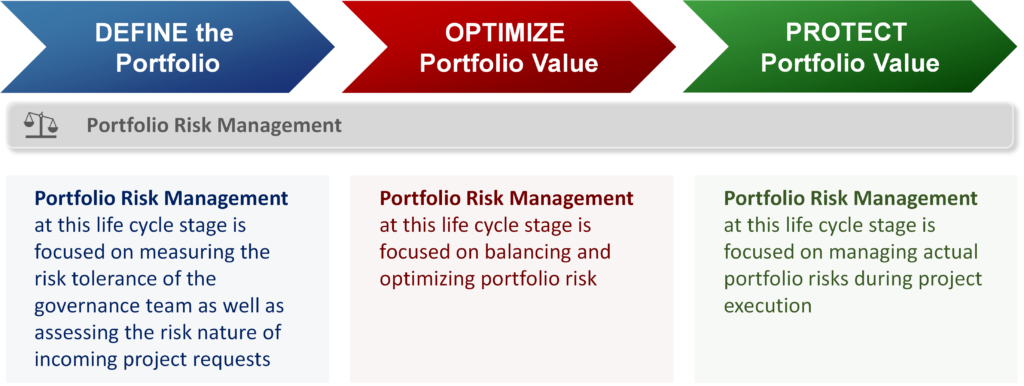

There are two essential parts of portfolio threat administration: portfolio threat tolerance and the chance administration of particular portfolio-level dangers. Each parts assist shield portfolio supply, however in numerous methods. We’ll begin with the extra conventional view of portfolio threat administration after which tackle how organizations can handle the chance tolerance inside their portfolio. The diagram beneath exhibits how portfolio threat administration suits throughout the portfolio lifecycle.

Portfolio Stage Dangers

The frequent view of portfolio threat administration includes managing particular portfolio-level dangers. These are dangers that jeopardize the efficiently completion of strategic targets. The aim of portfolio threat administration is to extend the chance of optimistic occasions and reduce the chance of unfavourable results impacting the mission portfolio. This side of portfolio threat administration largely happens through the ‘Shield Portfolio Worth’ lifecycle part.

The Mission Administration Institute says that portfolio threat “is an unsure occasion, set of occasions or situations that in the event that they happen, have a number of results, both optimistic or unfavourable, on not less than one strategic enterprise goal of the portfolio”. In line with Rachel Ciliberti, portfolio threat administration “contains processes that establish, analyze, reply to, monitor, and management any dangers that may stop the portfolio from attaining its enterprise targets. These processes ought to embody opinions of project-level dangers with unfavourable implications for the portfolio, guaranteeing that the Mission Supervisor has a accountable threat mitigation plan.” Organizations that need to enhance the supply success of their tasks want to determine portfolio threat administration processes.

Varieties of Portfolio Stage Dangers

Earlier than masking the portfolio threat administration course of, let’s first have a look at the frequent sorts of portfolio degree dangers: exterior enterprise dangers, inner enterprise dangers, and execution-related dangers.

Exterior Enterprise Dangers

Exterior enterprise dangers are occasions within the exterior surroundings which are outdoors of the management of the corporate. Examples embody:

- Disruption within the business (e.g. buyer developments reminiscent of having wants met by way of new know-how or providers)

- Modifications to rivals (e.g. mergers and acquisitions)

- Financial situations (i.e. recessions)

- Political surroundings (change of political social gathering that might affect future enterprise developments)

- Regulatory modifications

- New authorized necessities

- Pure occasions (e.g. COVID-19)

Any of the above exterior enterprise dangers can immediate a change in enterprise technique, which may end up in sure tasks turning into out of date since they now not match the enterprise technique. This will trigger important disruption to the present portfolio and requires robust portfolio governance to adapt to exterior modifications.

Inside Enterprise Dangers

Inside enterprise modifications or disruptions can affect mission and program supply. Some examples of inner enterprise dangers embody:

- Operational challenges: operational challenges reminiscent of impacts to a provide chain, delays in launching a brand new main services or products, and even insufficient enterprise processes can all affect mission supply. Relying on the scope of the Portfolio Governance Workforce, finances and sources could also be out there to deal with these challenges.

- Management/organizational modifications: senior management modifications can have an effect on or affect mission priorities and strategic course. Organizational modifications can affect useful resource groups and mission supply. When these occasions happen, the Portfolio Governance Workforce ought to establish methods of minimizing the unfavourable affect on inflight tasks.

- Portfolio Governance: Portfolio governance is an integral a part of portfolio administration. Sturdy portfolio governance permits the group, and the corporate, to reap the advantages of portfolio administration. When portfolio governance high quality degrades, the standard of portfolio administration decreases additionally. The Portfolio Governance Workforce Chairperson should make sure that portfolio processes are adhered to and attendance at portfolio conferences is robust to be able to perform portfolio administration duties.

- Monetary well being: the money place and income forecasts can enormously have an effect on energetic tasks. If an organization’s income forecast is considerably beneath plan, it will possibly sign the necessity to pause or cancel in-flight tasks.

Execution-Associated Dangers

Execution associated dangers embody mission dependencies, main mission dangers that affect two or extra different tasks, and mission administration high quality.

- Main Mission Dangers: some mission dangers are so extreme of their affect that it may jeopardize the supply of different tasks. In these instances, these particular person dangers will be escalated to the Portfolio Governance Workforce and monitored on the portfolio degree.

- Mission Dependencies: mission dependencies pose an excellent threat to particular person tasks and to the portfolio as a complete. The bigger the variety of interdependent tasks, the larger the chance that the portfolio will probably be in danger by a schedule slide from any of these tasks. With a purpose to keep constant mission supply, each the mission managers and the Portfolio Governance Workforce ought to actively monitor the important path between dependent tasks, which can assist either side anticipate potential schedule slides.

- Restricted Useful resource Capability: overutilized useful resource groups can considerably affect portfolio efficiency. The Portfolio Governance Workforce wants to observe utilization of important sources and guarantee useful resource groups are working in accordance with established priorities by leveraging good portfolio administration useful resource charts. Underneath-estimating useful resource forecasts may jeopardize supply by making it seem like there can be found sources.

- Mission Administration Requirements: weak mission administration high quality straight impacts mission supply. One perform of a Mission Administration Workplace (PMO) is to make sure the applying of fine mission administration self-discipline to the supply of tasks. The PMO can straight enhance mission administration high quality by way of coaching and hiring skilled senior mission managers (or consultants).

Handle Portfolio Dangers

On this part we are going to talk about methods to handle portfolio dangers. The Portfolio Supervisor performs a important function in establishing and establishing portfolio threat administration processes. In line with PMI’s Customary for Portfolio Administration, there are 4 main portfolio threat administration processes:

- Establish portfolio dangers—Portfolio dangers might come from a number of instructions. Main mission dangers are one element of portfolio dangers and must be recognized through the Work Consumption course of or throughout mission planning and reviewed frequently throughout portfolio evaluation conferences. Different portfolio dangers will probably be recognized by the Portfolio Governance Workforce.

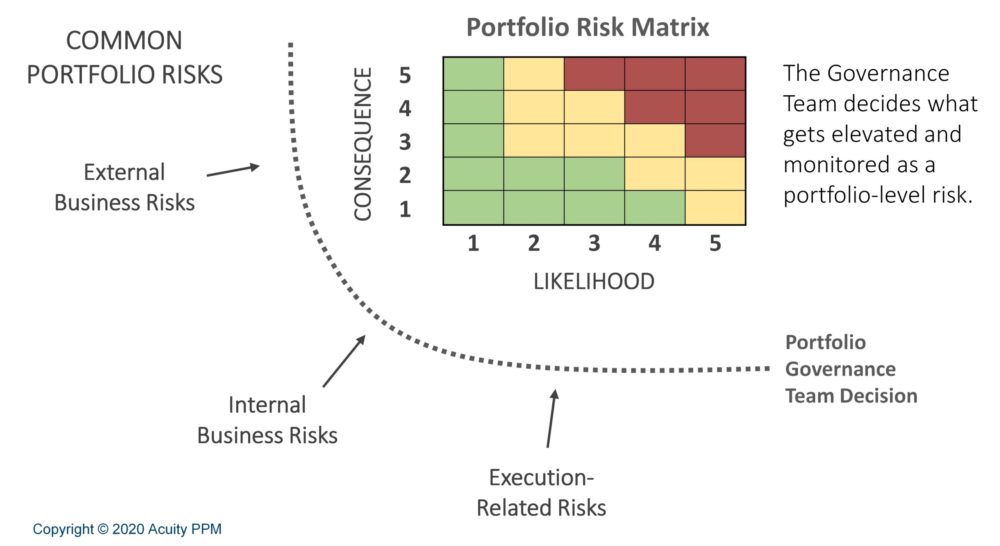

- Analyze portfolio dangers—Probably the most critical mission dangers are communicated to the Portfolio Governance Workforce at a portfolio governance assembly or portfolio evaluation assembly. The Portfolio Governance Workforce decides which dangers are elevated to the portfolio degree (see the determine beneath). The Portfolio Governance Workforce will even assess the severity and likelihood of different main portfolio dangers.

- Develop portfolio threat responses—Chosen Portfolio Governance Workforce representatives (or delegate) will probably be assigned as threat proprietor(s) to develop choices and actions to mitigate threats to portfolio efficiency. Portfolio degree dangers must also be prioritized.

- Monitor and management portfolio dangers—Portfolio dangers and mitigation plans must be tracked at Portfolio Governance Workforce conferences.

**PRO TIP: a sturdy Work Consumption course of will considerably assist in figuring out main mission dangers. Take into account updating your Work Consumption course of if you’re not at present figuring out new portfolio dangers.

Relying on the extent of rigor that a company places into its portfolio threat administration processes, it might select to conduct varied ranges of threat evaluation not restricted to cost-benefit evaluation, statistical modeling (likelihood evaluation, confidence limits), sensitivity evaluation, mission interdependency and timing evaluation, and so on. Organizations are inspired to make use of portfolio threat administration software program for optimum outcomes and never depend on spreadsheets. For extra particulars on managing portfolio dangers, please reference the Customary for Portfolio Administration.

Skilled Mission Managers will probably be aware of the chance matrix beneath. It will also be used to evaluate the relative consequence and chance of particular portfolio degree dangers. A portfolio threat log can be utilized to keep up a report of portfolio dangers and must be actively managed by the Portfolio Governance Workforce.

VIDEO

Alternative Administration

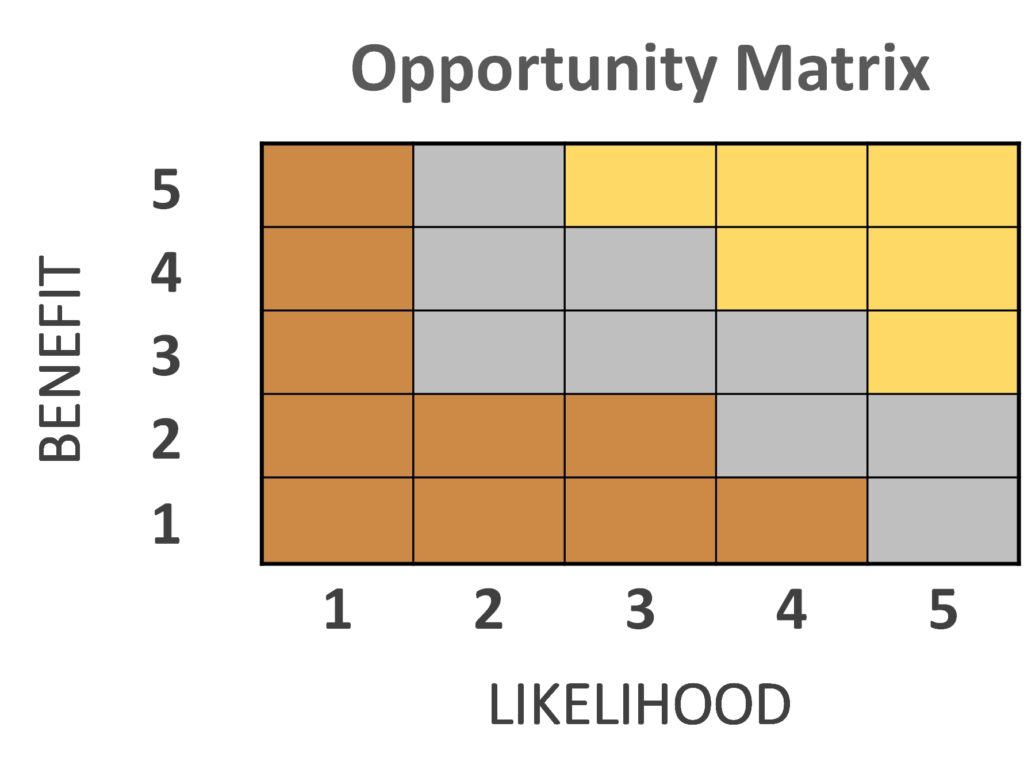

Alternative administration is a risk-related course of that firms can use to establish, analyze, and handle mission alternatives that allows organizations to realize extra mission worth or carry out higher than deliberate and by definition transcend the unique assertion of labor of a mission. Some alternatives might become devoted tasks or the work to seize the chance will be added to an present mission or program’s scope.

Though some concepts/alternatives could also be nice and supply a variety of worth, for one motive or one other, the timing is probably not proper or another constraint makes it tough to seize the chance. It might be a brand new market alternative that turns into out there, the aggressive panorama modifications, or an rising know-how is on the market to advance the group. Because of this, organizations ought to set up a chance log and periodically evaluation these alternatives and establish a superb time to make the most of the chance.

The processes for managing alternatives are just like the processes for managing dangers besides that alternatives are future occasions that might produce optimistic outcomes for the group. Alternatives usually fall into the “ought to do” or “may do” precedence classes, however allow organizations to realize extra or carry out higher than deliberate. As a result of most organizations are targeted on minimizing or eliminating unfavourable impacts to tasks (by way of threat administration), solely organizations with extra superior portfolio administration processes make the most of alternative administration. Portfolio threat administration software program can enhance the chance of capturing alternatives, particularly with the rise of synthetic intelligence.

The diagram beneath represents a 5×5 alternative matrix that might be used to graphically symbolize the present organizational alternatives. The X-axis represents the magnitude of profit and the Y-axis represents the chance of capturing the chance. Alternatives within the higher proper hand nook symbolize golden alternatives, these towards the decrease left nook symbolize bronze alternatives, and people within the center symbolize silver alternatives.

Portfolio Danger Tolerance

One other essential aspect of portfolio threat administration is the chance tolerance of the Portfolio Governance Workforce in managing the portfolio. Mission portfolio administration has its base in monetary portfolio administration the place one of many foundational principals is the power to diversify threat by way of a broad set of investments. Buyers perceive that riskier investments ought to include a better price of return and lower-risk investments (reminiscent of US Treasury Bonds) have a decrease price of return. Due to this fact, it can be crucial for buyers to grasp their very own threat tolerance based mostly on the anticipated degree of return. For example, younger professionals can afford to have a higher-risk retirement plan to be able to speed up the expansion of their retirement plan. Seniors then again will shift to a low-risk funding portfolio to be able to shield what they’ve already saved. The chance tolerance relies on the funding technique.

Understanding the portfolio threat tolerance is a crucial side of the primary portfolio lifecycle part “Outline the Portfolio” as mentioned in our overview of portfolio administration. That is how portfolio governance groups consider and choose tasks. Paradoxically, many Portfolio Governance Groups do an insufficient job of accounting for threat of their mission portfolio. Many tackle too many high-risk tasks after which surprise why the success price is just too low; that is to blindly handle the portfolio. Sensible portfolio administration groups have their eyes open to think about the chance tolerance of the corporate in addition to the riskiness of particular person tasks to be able to make clever mission funding choices.

Measure Danger Tolerance

With a purpose to measure the portfolio threat degree we first have to assess particular person mission riskiness after which measure every mission’s monetary and threat contribution to the portfolio.

Assess Mission Riskiness

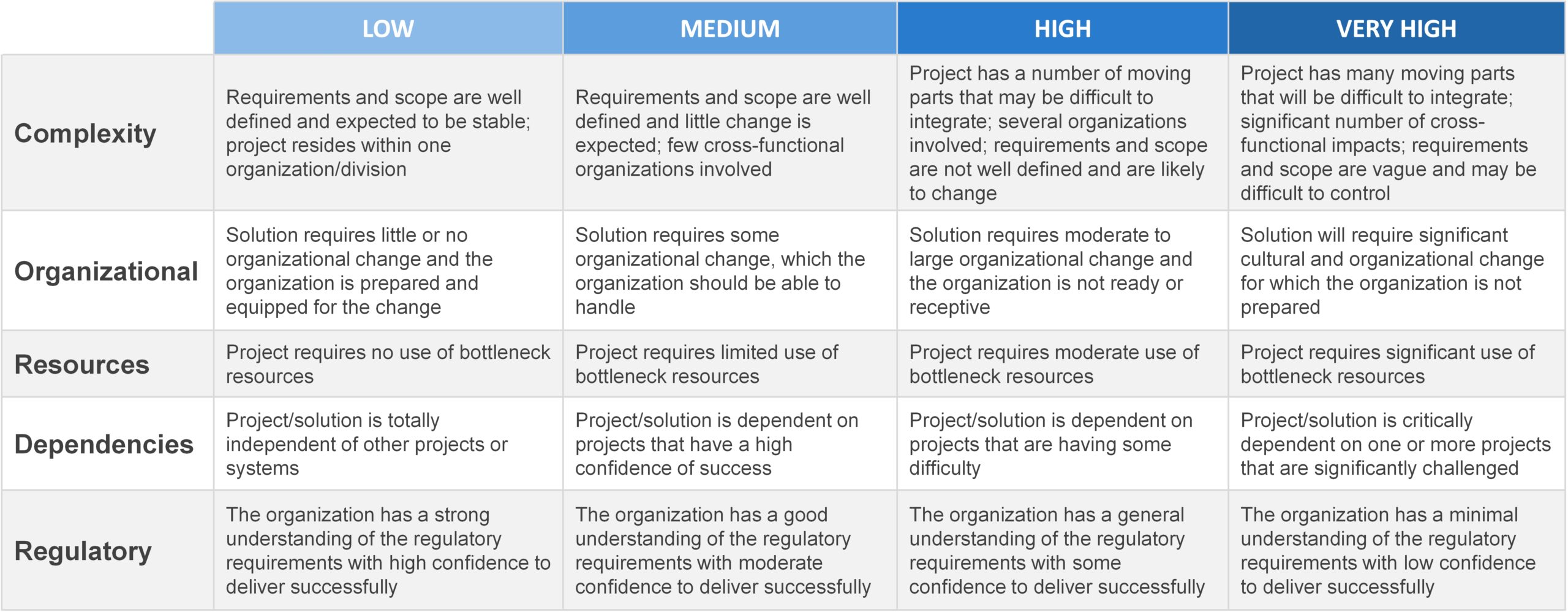

There are alternative ways of assessing portfolio threat, however our most well-liked method is to make the most of the prioritization scoring information you must already be amassing. In our publish on prioritization we mentioned how organizations ought to incorporate a threat factor into their scoring mannequin. These “threat scores” not solely assess the relative riskiness of a person mission however can be utilized to calculate an general portfolio threat rating which we are going to cowl beneath.

The picture beneath depicts pattern threat scoring standards {that a} portfolio governance staff (or mission staff) may use to judge the riskiness (threat nature) of a person mission.

The output of this train is a “threat rating” by which the relative threat of 1 mission will be in comparison with one other mission. This will also be used to judge the general threat degree of the portfolio.

Your group’s threat tolerance relies in your funding technique

Measure the relative contribution of every mission or program to the general portfolio

The subsequent step is to measure the relative contribution of every mission or program to the general portfolio. Earlier than we stroll by way of these calculations, we need to cowl some primary issues for measuring portfolio threat tolerance.

It’s important that we analyze the relative contribution of a single mission to an general portfolio threat rating.

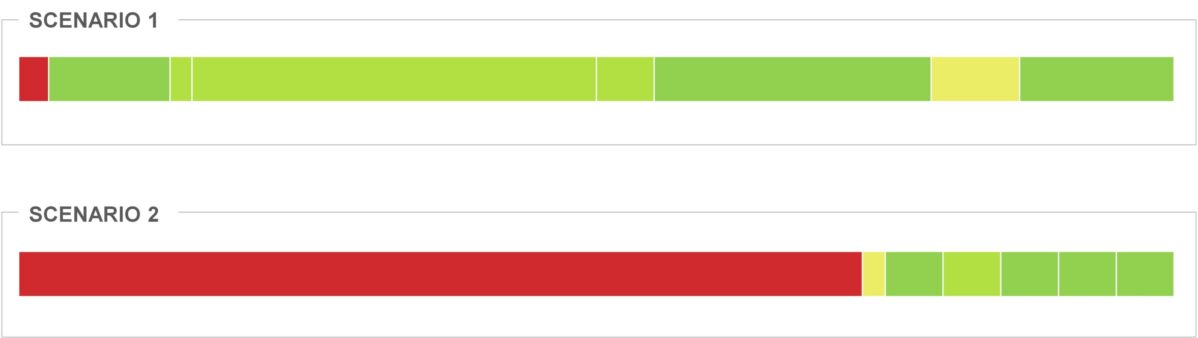

To exhibit this, we are going to use two easy illustrations (situation 1 and situation 2) to point out how a person mission’s threat worth impacts the general portfolio threat rating. The packing containers beneath in each situations symbolize tasks within the portfolio and the colour represents the relative degree of threat (green-low, red-high) and that the dimensions of the field corresponds to the relative finances in comparison with the entire portfolio. For simplicity sake, let’s fake that the entire portfolio finances is $10M and that the purple field in situation 1 represents a single mission that may be very dangerous however has a small mission finances ($100K). Does this portfolio have excessive portfolio threat? No. Although there’s a very dangerous mission, it accounts for a small quantity of the portfolio finances. Strictly based mostly on the chance scores and budgetary contribution, the portfolio will not be a dangerous portfolio.

In situation 2, let’s fake that our dangerous mission now prices $7M however the portfolio finances stays $10M. Does this portfolio have excessive portfolio threat? Sure. The very dangerous mission accounts for almost all of the portfolio finances. By advantage of being a high-risk mission that consumes the vast majority of the portfolio finances, the portfolio accommodates excessive threat. What we’ve proven right here is that portfolio threat relies on the relative contribution of dangerous tasks within the portfolio.

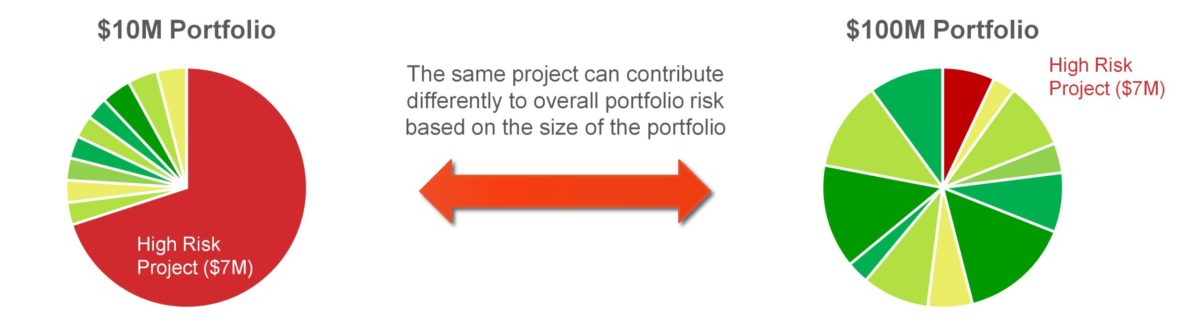

Total portfolio finances ranges may change and have an effect on measuring portfolio threat. Due to this fact, we additionally want to understand that portfolio threat relies on the present mission portfolio. As demonstrated within the earlier instance, you will need to measure the portfolio threat based mostly on the budgetary contribution of all tasks in comparison with the general portfolio finances. Due to this fact, as portfolio budgets change, the general portfolio threat rating might also change.

Let’s proceed the earlier instance. If the portfolio finances was enlarged to $100M (as an alternative of $10M); our very high-risk mission would now solely contribute 7% towards the general portfolio threat rating (as an alternative of 70% in situation 2 above). Assuming that a lot of the remaining tasks have been solely low to average threat, then the general portfolio threat decreased. The alternative may occur too, if the portfolio finances decreased then each mission within the portfolio can have a better contribution to general portfolio threat. We use these two easy examples to clarify the connection between mission threat scores, mission budgets, and general portfolio budgets.

Portfolio Danger Analytics

By doing this work, we will generate two very beneficial outputs (portfolio threat analytics):

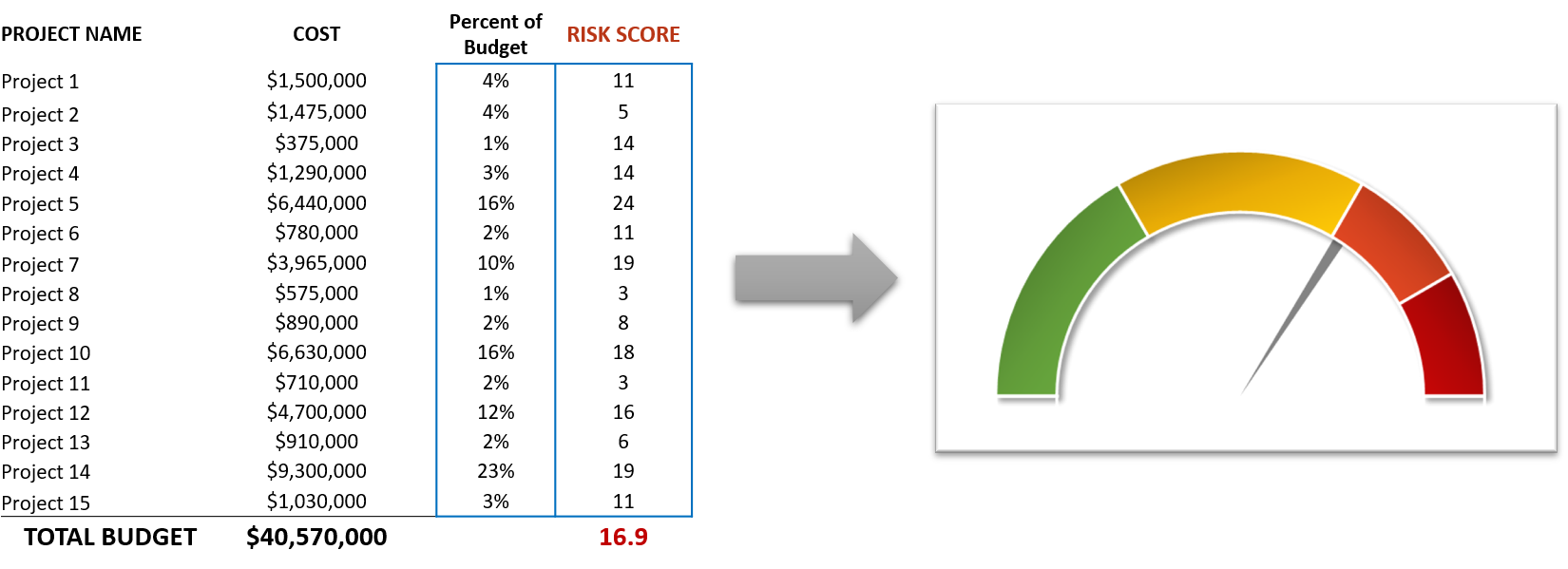

The portfolio threat gauge is an easy show to focus on the relative portfolio threat degree at a time limit. Organizations that assess mission dangers and have mission budgets can simply measure portfolio threat. By multiplying the budgetary contribution and the chance rating and summing this up, we will calculate a portfolio threat rating (16.9 within the instance beneath in contrast in opposition to a most portfolio threat rating of 25).

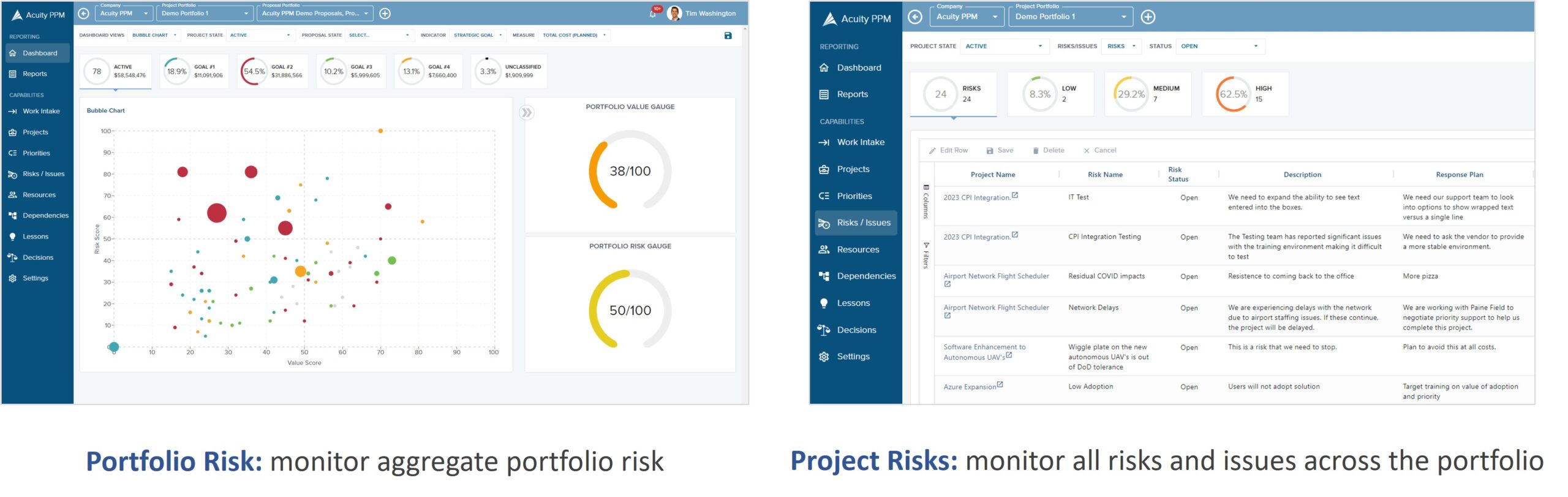

With this we will create a portfolio threat gauge (word: this may be completed manually in Excel and there are various tutorials on the net on methods to make this, or a device reminiscent of Acuity PPM can create this mechanically).

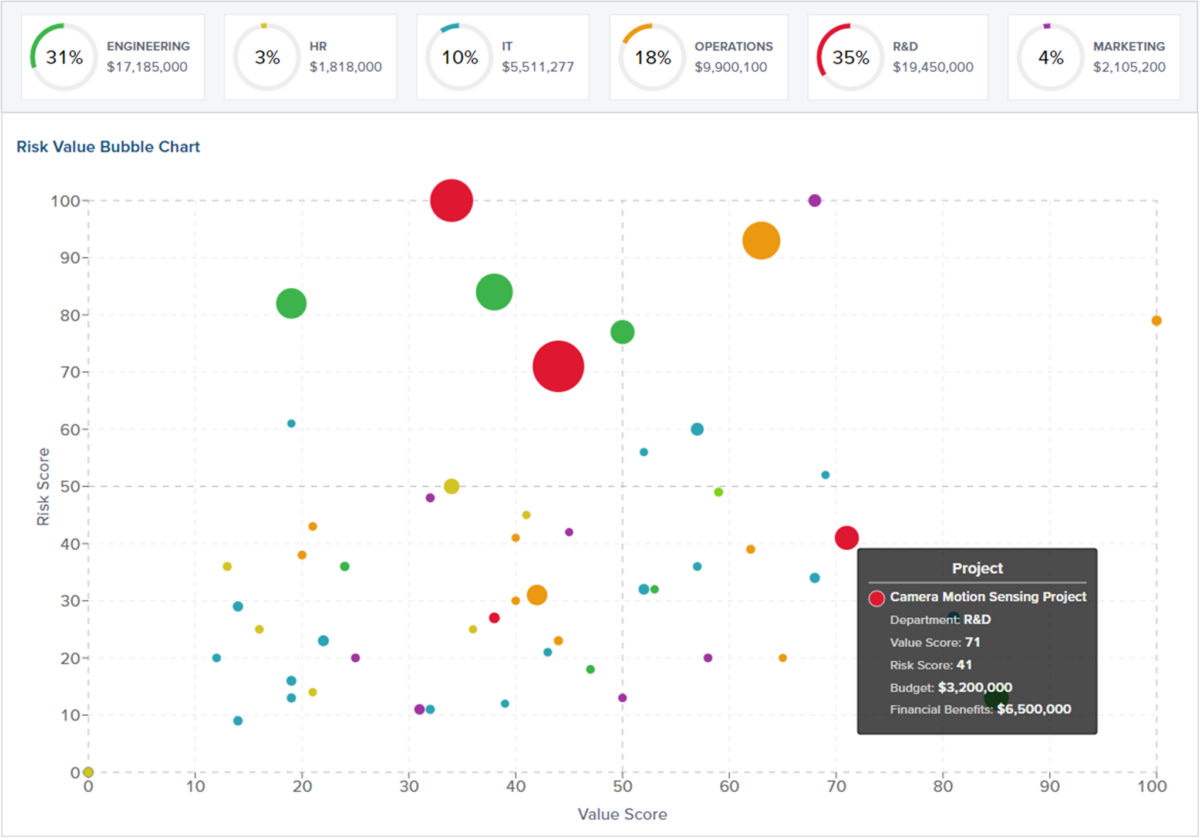

The opposite main output is a portfolio risk-value bubble chart (which was lined in our publish on prioritization). The chance-value bubble chart can be utilized to assist Portfolio Governance Groups stability threat and optimize the portfolio. It helps visualize high-risk however low-value tasks that must be screened out. This portfolio administration chart is very helpful within the second portfolio lifecycle part on optimizing the portfolio.

Different Methods of Assessing Portfolio Danger

We’ll end this part with a short abstract of different methods organizations can assess portfolio threat

- Useful resource capability: firms that measure useful resource capability can use this information to tell portfolio threat. Essential groups which are over-utilized symbolize a significant threat to mission supply. Monitoring the variety of over-utilized useful resource groups can inform portfolio threat from the side of useful resource capability.

- Extreme multi-tasking: a less complicated means of measuring over-utilized staff members is to measure what number of concurrent tasks persons are engaged on. Groups that excessively multi-task usually do not need sufficient working time to maintain tasks on schedule. This indicators one other side of portfolio threat.

- Mission and portfolio administration maturity: a really basic proxy for portfolio threat comes within the type of mission administration maturity. Organizations with low mission administration maturity are proven to have decrease profitable supply charges than greater maturity organizations.

Synthetic Intelligence and Portfolio Danger Administration

Synthetic intelligence will enormously enhance portfolio threat administration in three key methods:

- Synthetic intelligence (generative AI) can already be used to rapidly populate a mission threat log at the beginning of a mission based mostly on an in depth description of a mission. This can end in extra sturdy threat logs.

- AI fashions will be skilled to additional counsel potential dangers based mostly on further data fed right into a portfolio threat administration software program answer. Based mostly on milestone timing, mission delays, useful resource information, and different data, further dangers will be generated all through the lifecycle of a mission

- On the portfolio degree, AI can establish new dependency dangers between tasks and alert Portfolio Managers earlier than the dangers are realized as points.

Portfolio Danger Administration Software program

Acuity PPM portfolio threat administration software program as a part of its general mission portfolio administration answer. Acuity PPM helps you monitor mission efficiency, report mission and portfolio standing to senior leaders, handle and prioritize incoming mission requests, visualize strategic roadmaps, allocate sources and handle useful resource capability. All of this helps allow strategic agility in a altering surroundings. With Acuity PPM, you need to use mission threat scores to find out the combination portfolio threat your group is taking. You may as well acquire visibility to all dangers throughout the portfolio to higher handle portfolio threat.

Abstract

Portfolio threat administration helps safeguard portfolio worth and permits Portfolio Governance Groups to proactively handle the chance degree of the portfolio. By proactively managing threat ranges, organizations can efficiently tackle extra threat and thereby enhance general portfolio worth. Firms want to grasp what their very own threat tolerance is and measure it appropriately to higher handle the portfolio. Some firms and industries are extra threat tolerant (e.g. know-how companies, biotechnology companies, and so on.) whereas different firms are much less threat tolerant (e.g. retail, monetary providers, well being care, and so on.). Measuring portfolio threat and proactively managing to it would allow larger supply success and assist maximize portfolio worth.

Tim is a mission and portfolio administration marketing consultant with over 15 years of expertise working with the Fortune 500. He’s an knowledgeable in maturity-based PPM and helps PMO Leaders construct and enhance their PMO to unlock extra worth for his or her firm. He is without doubt one of the authentic PfMP’s (Portfolio Administration Professionals) and a public speaker at enterprise conferences and PMI occasions.

What’s mission portfolio threat administration?

Portfolio threat administration includes processes to establish, assess, measure, and handle threat throughout the portfolio and is concentrated on occasions that might negatively affect the accomplishment of strategic targets. The scope of portfolio threat administration is much broader than program and mission threat administration and requires senior management involvement.

What are frequent sorts of mission portfolio dangers?

Three classes of mission portfolio dangers embody: exterior enterprise dangers (business disruption, mergers and acquisitions, financial situations, political environments, regulatory modifications, new authorized necessities, pure occasions reminiscent of COVID-19), inner enterprise dangers (reminiscent of operational challenges, management and organizational modifications, weak portfolio governance, and firm monetary well being), and execution associated dangers (main mission dangers that affect two or extra different tasks, mission dependencies, restricted useful resource capability, and weak mission administration requirements).

What are the steps of a mission portfolio threat administration course of?

There are 4 key steps to the portfolio threat administration course of. 1) Establish portfolio dangers 2) Analyze portfolio dangers 3)Develop portfolio threat responses 4) Monitor and management portfolio dangers — portfolio dangers and mitigation plans must be tracked at Portfolio Governance Workforce conferences.

How do you measure portfolio threat tolerance?

Portfolio threat tolerance will be measured by first measuring the riskiness of particular person tasks and packages. This may be completed utilizing a superb scoring mannequin to judge execution threat. Subsequent, measure the relative contribution of every mission or program to the general portfolio. Based mostly on this, you possibly can create an combination portfolio threat rating which will be displayed in stories reminiscent of a portfolio threat gauge.